Answer: Interest rates vary depending on the down payment, existing equity, mortgage position, property type, ability to verify and the application. Generally, the more you can provide the more options that are available. Land only, Modular Homes, and other non-conventional properties are also subject to higher interest rates.

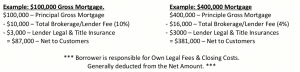

A typical private lending first mortgage on a residential property of 50% LTV warrants an 8% – 9% annual yield from a private lender. A general rule of thumb is for every 10% the LTV increases the annual yield increases by 1%. The Annual Yield is a combination of the contract rate and lender fee for each year. Brokerage Fees are extra.

A typical private 2 mortgage on a residential property starts at a 12% – 14% annual yield rate regardless of the LTV and will increase as the LTV increases. A general rule of thumb is for every 5% the LTV increases over 65%, the annual yield increases by 2%. The Annual Yield is a combination of the contract rate and lender fee for each year. Brokerage Fees are extra.