16 FAQ REGARDING EQUITY REFINANCE / PRIVATE 2ND MORTGAGES

Refinancing Options – 2nd Mortgage, Equity Take Out, Renewal

1. What is the Difference between a Second Mortgage and a Home Equity Line?

-

There are a few between second mortgage and home equity lines of credit. Second mortgage offer fixed rates for a fixed term. Home equity lines of credit have rates that fluctuate with the prime rate for the financial institution. Home equity lines are revolving credit lines that only require an interest only payment each month. Home Equity lines of credits are also demand loans that can be called at anytime by the Financial institution. That is a rare occurrence, but is generally triggered when the loan holder financial situation has a negative change. Fixed rate second mortgages are either interest only payments, or have a payment due each month with a portion going to pay down both principle and interest of the loan. Interest only option is more common with private lenders since they are meant to be short term.

2: Do I have to get my second mortgage from the same company as the first mortgage?

- No. The first and second mortgage are totally independent.

3: Can I get a Second Mortgage without Refinancing my 1st Mortgage?

Yes. We provide second mortgages behind existing 1st mortgages all the time. If you have a great rate on your first mortgage there is no reason to pay it out and refinance. Taking out a new second mortgage is a great idea to access your home equity for debt consolidation, debt restricting, business, home improvements, judgments, tax liens, etc. As long it makes sense, a second mortgage is a possibility.

4: Can I get a Second Mortgage if I have Bad Credit?

For Sure. Credit is the least of our concerns. Provided there is adequate equity and your request makes sense, a private First or Second Mortgage is possible.

5: What is the contract interest rate?

A typical private 2nod mortgage on a residential property starts at a 10% plus applicable fees. A lender yield generally starts at between 12% – 14%. A general rule of thumb is for every 5% the LTV increases over 65%, the annual yield increases by 2%. The Annual Yield is a combination of the contract rate and lender fee for each year. Brokerage Fees are extra.

Are there any upfront fees?

There are no upfront lender or broker fees on residential private mortgages. Commercial mortgages have upfront fees on a case by case basis.

7: What are the fees associated with getting a private mortgage?

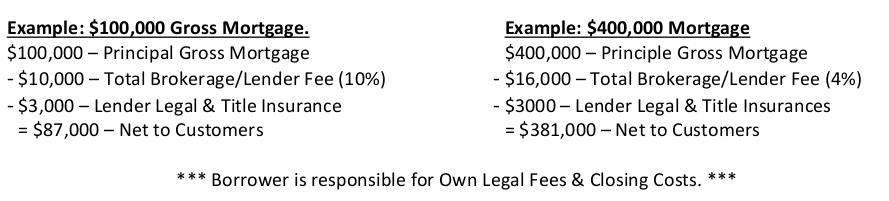

Combined Brokerage & Lender Fees generally start at 4% of the gross mortgage on mortgages greater than $150,000. Combined Brokerage & Lender Fees generally start at 10% of the gross mortgage on mortgages less than $100,000. Mortgages loans from $100,000 – $150,000 are generally somewhere between 4%-8% depending on the file

8: Why is the fee charge different on smaller and larger sized mortgages?

The time put into smaller and larger sized mortgages are generally the same. It would not fair to charge 10% fee on a larger mortgage, and it also would not be cost effective to reduce the fee on a smaller sized mortgage. Every situation is different, and there are cases where an exception is warranted.

9: What is the Loan-to-Value (LTV) that you can finance against my property?

On your typical residential property in an urban centre, private lenders will loan up to 80% of the property value. We do have access to lenders that will lend greater than 80%, but there needs to be a either a clear and quick exit strategy and/or a favorable 1st mortgage in place. Smaller rural communities are generally maxed out at 60% of the property value, with some lenders in the network that will consider 70%. ***Some exceptions apply to all files. ***

10: What are the pre-payment penalties?

Pre-payment penalties vary depending on the type of deal and the objective, but the common industry standard on closed mortgages is 3-months interest pre-payment, or a fixed percentage of original registered principal amounts. Some provide open or partially open options. No pre-payment penalties will apply to a fully open mortgage. FAQ 10: How long does the process take? Answer: The process is relatively fast provided we are receiving requested documents in a timely fashion. On average, once an appraisal, application, and supporting documents are received, a commitment can be issues in 3 days or less, but in many cases within 24 hours

11: How long does the process take?

The process is relatively fast provided we are receiving requested documents in a timely fashion. On average, once an appraisal, application, and supporting documents are received, a commitment can be issues in 3 days or less, but in many cases within 24 hours

12: Does a second mortgage have any tax benefits?

Possibly. If the funds will be used to invest or for business purposes, the interest can be a taxable benefit. Consult with your accountant.

13: What happens at the end of the term and I cannot get non-private financing?

As a property owner, it is your responsibility to put yourself in the best position possible to transition from private financing, but we also understand that life happens. When your maturity date is coming up, you will essentially have the following options:

1. Renew with your existing lender. Good Repayment history is required for the Lender to consider.

2. Refinance with a new private lender.

3. Refinance with a non-private lender provided you qualify. Minimal costs are associated with this option.

4. List the property for sale and move.

5. List the property for sale to an investor and become a tenant with an agreement to buy-back in the future or be a permanent tenant. If the above options are not exercised, the lender can/may initiate power of sale foreclosure proceedings.

14: If I don’t have enough equity in my property, do I still have options?

The options when property is lacking are few, but there are options. If the property is in an urban center or direct surrounding area and there is 10%-15% equity, the options would be as follows:

1. Provide some cash injection to meet a private lender’s criteria for the loan to value requirements.

2. If other property is owned where there is adequate equity, a blanket mortgage can be considered.

3. Sell your property. 4. Enter in to IPR (Investor Purchase Refinance). This is when an investor purchases the property from the property owner, and the property owner signs a lease as a tenant.

15: What documentation will I need to provide?

On standard urban residential properties where the combined mortgages on the property value is less than 65%, basically all this required is 2 pieces of Valid ID, a current mortgage statement, property tax assessment notice, an appraisal from an approved appraisal, and copy of home insurance policy. This is classified as equity based approval. When the LTV exceeds 65%, more documentation is needed such as appropriate income verification which varies depending on each file.

If you are a homeowner with some equity in your house, and you need some extra money, a second mortgage is often the answer. A second mortgage serves a number of different purposes, but understanding what they are and how they work is an important part of managing your money.

What the word “second” means is that this loan lacks first priority in case of a default. If you fall behind on your mortgage and it goes into default, the foreclosure sale would pay off the first mortgage first, with any remaining proceeds going to satisfy the second loan.

The only reason to place your property at this sort of risk is if you need a lot of money. This isn’t something you would necessarily do for credit card debt, unless it was well into five figures. If you have lived in your property for several years, your mortgage payments may have built up enough equity so that you can still get a second mortgage without going upside-down in terms of value versus remaining debt. Some of the more frequent reasons for second mortgages include:

- Improvements on the home Putting together enough of a down payment to avoid PMI (private mortgage insurance)

- Consolidating other debts

- Purchasing other property Establishing a home equity line of credit

There are still other uses for second mortgages, but it is important to be wise when you are putting your application in for more credit, because it is your home that is at risk. If you end up failing to pay the second mortgage, you can lose your home just as easily as you can for failing to pay a first mortgage, so make sure that you have the funds in your budget to pay for both loans before taking the second one out.

Another factor to consider with a second mortgage is that the interest rates are usually somewhat higher than first mortgages. The reason for the higher rate is that the second loan has less priority than the first one. This means that the risk for the bank is higher — and they pass that risk along to you with a higher cost for the credit. However, the rate for a second mortgage is generally lower than the rate you would pay for a credit card. Another cost that you need to be aware of is the origination fees for a second mortgage. With many lenders, these fees are higher than they are for first mortgages, and they can either add a lot to the principal you are borrowing or require a major expenditure at the beginning of the loan. Make sure to find out about all of these fees before you sign any contract for a second loan.

A home equity loan involves a slightly different sort of scenario. You’re happy with the interest rate on your loan, but your son is about to head off to college, and you haven’t been able to qualify for the low-interest loans that some colleges offer because of your income. So you find out that you could take out a home equity loan for significantly less interest expense than what he would pay if he had a student loan. This is a situation in which this sort of loan would make sense. Let’s take a closer look at the difference between refinance and taking equity out.

A home equity loan has your property as its security, which is why it generally has a lower interest rate than unsecured credit, either in the form of a loan or credit cards. You can either take out a traditional loan, which means you get a check for an agreed sum and then start paying back that principal with interest over he agreed term. If you take out a home equity line of credit (HELOC), that’s more like a credit card. You have approval to take out a set amount of money, but you don’t have to take it out right away, and you don’t have to take it all at once. You have a set draw period in which you can take out money, and if you do take it out, after the draw period ends, you start paying it back. It’s important to remember that in urban and rural markets you can get as much as 80% of your home’s equity out in a loan, provided your credit meets prime lender requirements.

Both the home equity loan and the HELOC come with closing costs, and the bank will ask your documentation to show that you qualify for it. A home equity loan will usually have a higher interest rate than your initial mortgage. However, be careful about lenders who advertise an introductory rate, because that low rate can spike after the introductory time period (maybe six months or a year), leaving you paying much more.

Renewal is what happens at the end of your mortgage term. If you took out a five-year note to start your mortgage, amortized over 25 years, after those first five years, you will have to renew the loan if you cannot pay it off. If you haven’t refinanced and are approaching the end of your term, here are some considerations as you approach the renewal process.

1.) Are you in a position where you want more flexible payment options?

A closed mortgage often comes with lower interest rates than its open counterpart. However, you can’t pay early without incurring interest-based penalties. If you take out an open mortgage, the rates are likely to be higher, but you can counteract that (and often more) by paying ahead of time. If you think your income is going to go up, consider the benefits of being able to pay your note off early without penalty.

2.) Would fluctuating interest rates ruin your budget?

You can get an adjustable rate mortgage (ARM) that starts out at a much lower interest rate than a fixed rate loan. You are taking on the risk of having your rates jump up (to a pre-set maximum) if market rates increase. However, if you take out an open ARM, you can really get ahead with double and triple payments with rock bottom interest rates.

Refinance Mortgage Checklist

8 TOP REASONS TO USE AMANSAD FINANCIAL PRIVATE LENDING SERVICES

1. Fast & Efficient

Amansad Financial has a large DLGN (Direct Lender Group Network) that will fund mortgages throughout select provinces in Canada and will generally provide a response within 24 to 48 hours. Our process is generally 50% faster than most other competitors. From the initial assessment to closing with the lawyer, our transactions move extremely quickly.

2. Private Lending Expertise

Amansad Financial specializes in providing great insight and solutions for customers that do not qualify for traditional bank mortgages. A high majority of the customers we assist have either bad credit and/or simply require a fast mortgage.

3. Extended Lender Relationships

In addition to the DLGN, Amansad Financial also has established relationships with numerous MIC (Mortgage Investment Corporations) across the county that are able and willing to fund large amounts with fair terms.

4. No Upfront Costs To You

Amansad Financial does not charge an upfront fee to complete an initial review and assessment. We do not collect any monies direct from our customers. All applicable fees are deducted from the proceeds of the mortgage and completed by the lawyer.

Note: A Commercial Mortgage Application may be subject to a Letter of Engagement and a Retainer Fee after an initial review of the file.

5. Independent Legal Advice

Amansad Financial requires that all our customers get ILA (Independent Legal Advice) on all mortgages.

6. Transitionary Credit Improvement Services

In Cases where private lending is required primarily due to bad credit, we have strong relationships with 3 rd Party Credit Improvement Companies that will provide you the tools to improve your credit so that you can get back to traditional financing quicker. Private mortgages are not meant to be long term. A Private Mortgage is a means to get you from point A to point B.

7. Transitionary Mortgage Professionals

Amansad Financial Services has partnerships with excellent professionals within the brokerage firm; Brokers for Life Inc. They will be available to assist you to transition you from a private mortgage to a traditional or semi-traditional mortgage before your mortgage renewal.

8. Ongoing Communication

Even after your private mortgage is in place, Amansad Financial will stay connected with you and always be available to address any questions.

If you’re going to take out a private mortgage, you’re starting a relationship with a lender that will work a little differently than what you can expect from a bank or other traditional lender. Let’s take a look at some of the key differences, so you’ll know what you have in store.

Repayment History

Most people take out a private mortgage to get started on home ownership while they’re still repairing their credit. Private mortgages generally have short terms (often one to two years) and sometimes just allow interest-only payments. Private lenders do not have to renew mortgages when the term expires, so you want to keep your options open by making your repayments on time. Your credit score will improve (increasing your chances of a transition to a bank or other traditional lender at renewal). If you realize that you need to adjust your withdrawal date for a particular payment, give your lender at least a week’s notice.

Employment Changes

If you change employers during the term of a private mortgage, there are no requirements mandating that you update that information. However if you do provide that update, you strengthen your relationship with the private lender, showing that you are serious about bettering your financial situation. Even if you haven’t notified your private lender of the change, that will be a requirement for extending or renewing the loan in many cases.

Improving Your Credit

If you took out a private mortgage while you intended to improve your credit, there are improvement counselors who can help you get that score up. The purpose of this is to help you qualify for a bank loan when the private mortgage term expires – which will save you tens of thousands of dollars over the amortization of the entire mortgage.

Obtaining New Credit

Try to avoid opening new lines of credit, and keep your credit inquiries to a minimum during the term of your private loan. These activities can affect your score adversely, which definitely will not help you when it’s time to shift from a private lender to a bank or traditional lender.

The Value of Communication

Remember – a private lender is entrusting you with a great deal of capital. The clearer your communication is, the stronger your relationship will be. Private lenders are much more willing to work with borrowers who are honest and upfront.

Daniel K. Akowuah

Mortgage Professional

Amansad Direct Lending Group

DLGN Underwriter

Brokers For Life Inc.(Brokerage)

Contact:

PH:1(780)756-1119

TF:1(877)756-1119

FX:1(877)238-7794

[email protected]

Got Questions Prior To Proceeding? Reach Out For Answers!

Customer Testimonials

NEED MORTGAGE FINANCE, REFINANCING,

OR A SECURED ASSET LOAN?

✔ No Initial Credit Check Inquiry (Only 30 seconds to complete)

✔ Same Day Response

✔ Fast, Efficient, & Friendly Service

✔ Private Mortgages are based primarily on Equity and the Property

✔ Same Day Response

✔ Fast, Efficient, & Friendly Service

✔ Private Mortgages are based primarily on Equity and the Property

✔ Bad Credit Mortgages are based primarily on Equity and the Property

✔ Traditional & Semi-Traditional Options also available

✔ Equity Based Secured Asset Loans

(The world moves FAST, RESPECTING your time is important.)

Daniel K. Akowuah

Mortgage Professional

Amansad Direct Lending Group

DLGN Underwriter

Brokers For Life Inc.(Brokerage)