On March 1, 2021, significant change came to the syndicated mortgage market in all provinces of Canada except Ontario and Quebec, thanks to alterations in the national regulatory structure. The last two provinces saw the changes become effective on July 1, 2021. The primary focus of the changes is amendments to the exemptions for registration and the prospectus that apply to syndicated mortgage distribution with respect to securities laws. These amendments are designed to shield investors in syndicated mortgages and resolve regional discrepancies in the Canadian Securities Administrators (CSA) rules regarding this area. If you are considering an investment in the syndicated mortgages market, or if you already have holdings in this sector, then this article is relevant to your financial planning.

What Is a Syndicated Mortgage?

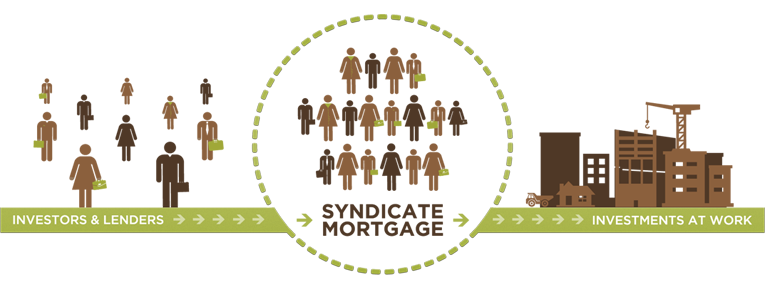

Like any other mortgage, a syndicated mortgage is a loan from an investor or lender to a borrower. The term “syndicated” means that the mortgage has multiple lenders or investors. Borrowers still face the same contractual obligation that they have with a single-lender loan, and for the investor, this investment is significantly more secure than mutual funds or the stock market. Even so, there is risk involved with a syndicated mortgage – as there is with any investment whose returns are not guaranteed by the government. You can lose a lot, or even all, of the money you invest, if the borrower goes into default. However, the borrower does have a contractual obligation to pay the money back with interest, and investors also have the benefit of collateral against the mortgage in case of default. However, in the case of borrower default, you would be stuck with settling for a share of the sale of the property involved. It’s important to remember that syndicated mortgages are securities, not guaranteed investments, and there is no set rate of return. You are limited from sending the loan into a secondary market due to the terms of the contract. In most cases, these loans are eligible for RRSP, TFSA, LIRA, RRIF and RESP withdrawals.

Qualified vs Non-Qualified Syndicated Mortgages

A qualified syndicated mortgage has to meet the following criteria:

- A mortgage brokerage must arrange or negotiate the loan

- The syndicated mortgage insurance (SMI) provides security for debt on property that is used primarily for residential purposes, has no more than four units and, if commercial purposes occur on site, they can occupy no more than one unit

- The aggregate debt, including the new syndicated mortgage, must not comprise over 90% of the property’s fair market value, leaving out any value that can be attached to potential development

- It can apply only to one debt obligation with the same term as the syndicated mortgage.

- The payable rate of interest has to be equal to the interest rate of the debt obligation.

Non-qualified syndicated mortgages involve significantly greater risk for the investor; they are mortgages that do not meet the qualifications listed above. Instead, they make up what is often called “mezzanine” financing. This refers to money that pays for such “soft costs” as zoning permits, sales and marketing expenses, architecture costs, and consultant fees. These costs are often paid out before the property can be developed, and these mortgages are frequently sold on the basis of projected value of the development after completion without a disclosure of the risks inherent to investing in real estate. These mortgages are generally not in first position in the case of failure to complete a construction project. So if a project goes awry, non-qualified syndicate investors can lose all the money they had put into the project.

The changes to the syndicated market process begin with an end to exemptions for dealer registration and general mortgage prospectus. Mortgage sellers who want to apply for an alternative mortgage prospectus exemption will have to file a report of exempt distribution that reveals details of each transaction and pays the attached filing fees within ten days of every transaction. Now, parties in syndicated mortgage deals may have to apply for and secure registration as a dealer or run the contract through a dealer who has already been registered. This could lead to higher transaction costs and lead to the application of the complete range of regulatory guidelines that registered individuals and firms must follow.

With respect to the “private issuer” prospectus exemption that appears in section 2.4 of National Instrument 45-106, which currently does not require a report to be filed for exempt distribution or the disbursement of required regulatory fees, that will go away when it comes to distributing a syndicated mortgage. By moving to exemptions that have a reporting requirement, the goal is to improve monitoring and regulation of the market with more information.

The ”offering memorandum” prospectus exemption that appears in section 2.9 of National Instrument 45-106 will change to add requirements that go into effect when the exemption goes toward syndicated mortgage distribution. One significant change is the requirement of a delivery of an appraisal of the property’s current fair market value; another is the mandate for use of a modified offering memorandum form.

Exempt Market Dealer Requirement

In order to become an exempt market dealer, you must take and pass this course. If you are interested in learning more about how to find an investment in syndicated mortgages, reach out to one of our experts at Amansad Financial. The property market continues to heat up, and the end result is more opportunities for profits.